Reducing Business Risk: Predictive Innovation®

Every investor is concerned about risk. How do you accurately assess the risk of an innovation investment? Can you calculate an Innovation Quotient to measure it? How do you control your exposure to the risk? Can you reduce your risk and still maintain desirable profits? Yes, with the Predictive Innovation®.

All traditional methods of risk management assume you can’t truly measure risk, thus you just try your best to reduce the impact of risk. Techniques such as diversification, or stage-gate assume you can’t measure the risk and must resort to trial and error. Basing your decision on past results also is inadequate, especially when dealing with innovation. As the disclaimer states, “past performance does not guarantee future results.” Any real innovation has no past performance; it’s new, that is the point.

Predictive Innovation® reduces or eliminates the three sources of risk.

- Will the customers buy it?

- Can you profitably make it?

- Can you beat the competition?

The Predictive Innovation® first converts customers’ subjective desires into precise objective outcomes. This allows you to measure how well each idea satisfies the current and future desires. This is essential because releasing a product too soon is as dangerous as too late. Once you have an outcome diagram you don’t need costly surveys. You can actually measure how well your product meets objective requirements.

The next step of Predictive Innovation® shows you how to profitably make it and beat the competition.

All the solutions to any problem can be described by a set of 7×15 Alternative Matrices. Each of the 105 boxes in the Alternatives Matrix is an approach to solving the problem or satisfying the requirement. These 105 types describe every solution even if current technology can’t yet build it.

Since you can describe all the solutions there is no risk. You simply look at each alternative and choose the one that works. Plus you have every response to competition laid out ahead of time. You can design your product and business strategy so you can easily shift from one solution to the next always staying ahead of competition.

Perhaps best of all, you can accurately measure the risk and reward with an Innovation Quotient. Each box of the Alternatives matrix for each Outcome is an innovation. Some of them are on the market, others are Blue Ocean waiting to be developed.

To calculate risk, simply count the number of untapped boxes and divide by the total for an Innovation Risk Quotient. The higher your Innovation Risk Quotient the greater your chance of success.

To calculate value, use normal market size and value methods for each box then sum the available boxes. This is the real total available market. Since you already have detailed descriptions of each innovation you can accurately estimate cost providing you with Return On Innovation.

Predictive Innovation® Maximize profits, Eliminates risk, and neutralizes competition.

Reducing Business Risk: Predictive Innovation Method

Every investor is concerned about risk. How do you accurately assess the risk of an innovation investment? Can you calculate an Innovation Quotient to measure it? How do you control your exposure to the risk? Can you reduce your risk and still maintain desirable profits? Yes, with the Predictive Innovation Method.

All traditional methods of risk management assume you can’t truly measure risk, thus you just try your best to reduce the impact of risk. Techniques such as diversification, or stage-gate assume you can’t measure the risk and must resort to trial and error. Basing your decision on past results also is inadequate, especially when dealing with innovation. As the disclaimer states, “past performance does not guarantee future results.” Any real innovation has no past performance; it’s new, that is the point.

Predictive Innovation Method reduces or eliminates the three sources of risk.

- Will the customers buy it?

- Can you profitably make it?

- Can you beat the competition?

The Predictive Innovation Method first converts customers’ subjective desires into precise objective outcomes. This allows you to measure how well each idea satisfies the current and future desires. This is essential because releasing a product too soon is as dangerous as too late. Once you have an outcome diagram you don’t need costly surveys. You can actually measure how well your product meets objective requirements.

The next step of Predictive Innovation Method shows you how to profitably make it and beat the competition.

All the solutions to any problem can be described by a set of 7×15 Alternative Matrices. Each of the 105 boxes in the Alternatives Matrix is an approach to solving the problem or satisfying the requirement. These 105 types describe every solution even if current technology can’t yet build it.

Since you can describe all the solutions there is no risk. You simply look at each alternative and choose the one that works. Plus you have every response to competition laid out ahead of time. You can design your product and business strategy so you can easily shift from one solution to the next always staying ahead of competition.

Perhaps best of all, you can accurately measure the risk and reward with an Innovation Quotient. Each box of the Alternatives matrix for each Outcome is an innovation. Some of them are on the market, others are Blue Ocean waiting to be developed.

To calculate risk, simply count the number of untapped boxes and divide by the total for an Innovation Risk Quotient. The higher your Innovation Risk Quotient the greater your chance of success.

To calculate value, use normal market size and value methods for each box then sum the available boxes. This is the real total available market. Since you already have detailed descriptions of each innovation you can accurately estimate cost providing you with Return On Innovation.

Predictive Innovation Method Maximize profits, Eliminates risk, and neutralizes competition.

Medicare.gov Ignores Security Problem Loses Disabled Woman's Identity

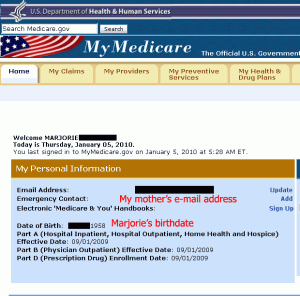

Marjorie, a disabled 51 year old woman, lost her identity and she doesn’t even know it yet. Her data was mixed with another person’s data. Worse than just losing her identity, Medicare caused the loss and failed to fix it when told of the problem.

Marjorie, a disabled 51 year old woman, lost her identity and she doesn’t even know it yet. Her data was mixed with another person’s data. Worse than just losing her identity, Medicare caused the loss and failed to fix it when told of the problem.

My mother receives Social Security, and is on Medicare Part A, B, C and D. She was setting up her online access to her Part C. These programs each have a separate online account even though all of it is overseen by Medicare and linked to Social Security. So she has a minimum of three online accounts and possibly five depending on which Part D plan she receives. Naturally she forgot the login information for one of the accounts.

My mother went to the www.Medicare.gov web site tried to login and was frustrated so she clicked the “Forgot Password” button. She entered her SignInID and Secret word. She changed her password and a confirmation email was sent to her registered email account. No problem, right? WRONG!!!

My mother changed the password and logged on but it said the account belonged to a woman named Marjorie who lives in another state. When my mother logged in she got Marjorie’s account with all of her medical data. Read more

My mother changed the password and logged on but it said the account belonged to a woman named Marjorie who lives in another state. When my mother logged in she got Marjorie’s account with all of her medical data. Read more

Predictive Innovation Training

Predictive Innovation Training Predictive Innovation: Core Skills Book

Predictive Innovation: Core Skills Book RoundSquareTriangle.com

RoundSquareTriangle.com